Build Your Financial Confidence

Most people weren't taught how money actually works. And that's frustrating when you're trying to make good decisions. Our program focuses on the mindset shifts and practical thinking patterns that successful investors develop over time. Not get-rich-quick schemes—just honest financial education.

Start Your JourneyWhat You'll Actually Learn

The program runs over four months, with workshops held twice monthly at our Dublin location. We keep groups small—usually around twelve participants—because real learning happens through conversation, not lecture halls.

Sessions run in the evenings (usually 7pm) to fit around work schedules. Starting September 2025.

Understanding Risk

We start by examining how people actually think about risk versus how they should. You'll work through real scenarios and identify your own biases—everyone has them.

Market Behavior

Markets don't move randomly, but they're also not predictable in the way most beginners hope. You'll learn to read patterns without falling into conspiracy thinking.

Building Strategy

Theory means nothing without application. This module focuses on developing your own approach based on your actual situation—not someone else's circumstances.

Long-Term Thinking

The final sessions are about maintaining discipline when things get uncomfortable. Because they will. Markets cycle, and your strategy needs to survive reality.

Interactive Workshops

Each session includes case studies from actual Irish investors. You'll analyze decisions, debate approaches, and see where different strategies lead. Learning from others' mistakes is cheaper than making your own.

Personal Development

Between sessions, you'll work on assignments tailored to your goals. These aren't busywork—they're about applying concepts to your actual financial situation and getting feedback.

Ongoing Resources

After completing the program, you'll have access to quarterly meetups where past participants share updates and challenges. Financial education doesn't end after four months.

How We Actually Teach

Evidence Over Stories

Sure, success stories are nice. But we focus on research, data, and what historically works. You'll learn to distinguish between lucky outcomes and sound strategy.

Honest About Limitations

No one can predict markets consistently. Not us, not anyone. We teach you to work within uncertainty rather than pretending it doesn't exist.

Practical Application

Every concept gets tested against real situations. If something doesn't work in practice, we don't waste time on theoretical elegance. Your goal is better decisions, not academic knowledge.

Individual Circumstances

What works for a 25-year-old with no dependents differs from what suits a 45-year-old with a mortgage. We don't offer one-size-fits-all advice because that's nonsense.

Callum Breslin

Programme Lead

Spent fifteen years in portfolio management before switching to education. Knows the industry well enough to be skeptical of most advice you'll read online.

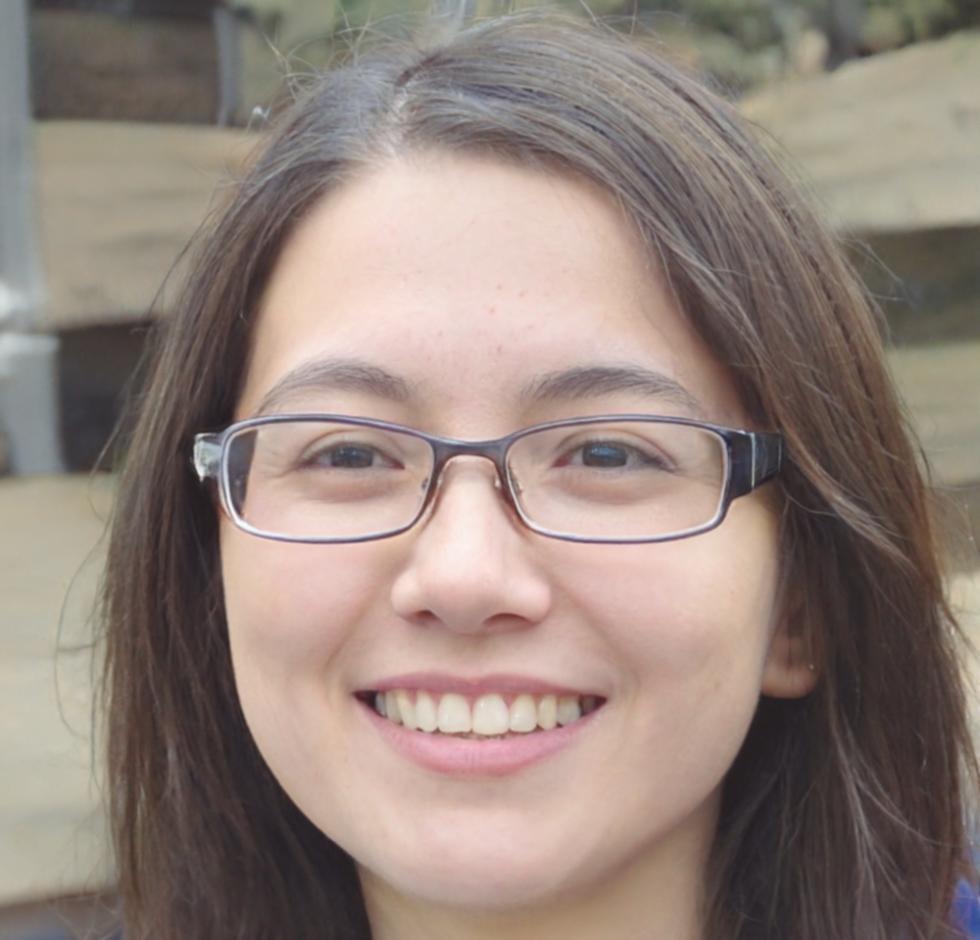

Orla Whelan

Behavioral Finance

Focuses on why smart people make dumb financial decisions. Her sessions on cognitive biases are the ones participants mention most often afterward.

Finn Ó Dálaigh

Market Analysis

Former financial journalist who covered three market crashes. Brings a healthy dose of realism to discussions about returns and expectations.

Programme Details

We run two cohorts annually—autumn and spring intake. Places are limited because we've found that smaller groups produce better discussions and more individual attention. Most participants are working professionals looking to develop genuine financial understanding.

What you need to know: This isn't a course about specific investment products or tax strategies (though those topics come up). It's about developing the mental framework successful investors use. If you're looking for hot stock tips or guaranteed returns, this isn't the right fit. If you want to understand how financial decisions actually work, we should talk.